You must contact us if you have discovered errors/missings or have questions.

This page is not available in English.

Salary subsidy

The enterprise may receive a subsidy for the period 15 March to 30 June if it meets all of the following requirements:

- 15 November 2020

- 1, 15, or 31 December 2020

- January 2021

You may only apply for a subsidy for employees who were fully or partially laid off on 5 March 2021 and on one or more of these dates in the list above.

The employee need not have been laid off for the entire period, as long as he or she was fully or partially laid off on one of the specified dates in 2020/2021 and on 5 March 2021.

The correct way to lay off employees (in Norwegian only) (NAV)

You cannot apply for a subsidy for employees that were laid off after 5 March. Nor can you apply for a subsidy for employees that were brought back by the enterprise before 5 March.

Specific information for enterprises that have employees working in the layoff period

By employees, we mean workers who work in the enterprise and who receive salaries or other remuneration for their work from the employer. Apprentices are also considered employees according to this scheme.

Freelancers/contractors (in Norwegian only) and self-employed persons/businesse (in Norwegian only) are not considered employees, meaning you cannot apply for a subsidy for them. Self-employed persons/businesses may apply on behalf of their employees, but are not considered employees themselves.

You may only apply for subsidies for employees that are registered as laid off in the Aa Register.

If one or more of these points apply to your enterprise, you cannot apply:

- The enterprise has entered bankruptcy proceedings.

- The enterprise has notified the courts and asked them to initiate bankruptcy proceedings.

- The enterprise is registered as in the process of being wound up in the Register of Business Enterprises.

- The enterprise has persons with leading roles that have been disqualified from running a business.

- The enterprise has creditors that have secured a special entitlement to payments made to the applicants account, meaning the subsidy cannot be used to cover salary costs.

An enterprise that have entered bankruptcy proceedings according to chapter VIII of the Bankruptcy Act will not be granted or paid a subsidy. In this context, an enterprise has entered bankruptcy proceedings from the moment the district court has ruled that the bankruptcy proceedings should be initiated (‘start day’). Nor will enterprises that have a petition for bankruptcy submitted against them according to the rules in chapter 16 of the Companies Act or the Public Limited Liability Companies Act be granted a subsidy.

Enterprises that are in negotiations with their creditors in accordance with the temporary Act relating to restructuring to remedy the financial problems as a result of the Covid-19 outbreak (Restructuring Act), are not considered to have entered bankruptcy proceedings. These enterprises may therefore apply for subsidies.

The enterprise must meet all the criteria relating to:

- Running a legitimate operation

- Enterprises that offer cleaning or staffing services, employees' health services or asbestos removal, must be approved and registered by the Norwegian Labour Inspection Authority according to the applicable rules.

- Vehicle garages must be listed in the Norwegian Public Roads Administration’s register.

- Electrical enterprises must be registered in the Electrical Enterprise Register.

- Enterprises are otherwise required to obtain the necessary approvals, certifications or licenses that are required in their sectors.

- Being able to document their complete ownership structure.

- If the enterprise is liable to pay tax: Having paid taxes, duties and advance tax deductions that were due before 29 February 2020. Tax-exempt institutions must be up to date with any tax returns for VAT and advance tax deductions.

Important informationIf you have arrears that fell due before 29 February 2020, you must settle these before you can apply. After you make the payment, you should wait a few days before applying to allow for the payment to be registered.

- The enterprise must have submitted mandatory reports, returns and statements (in Norwegian only)that fell due between 1 January 2019 and 15 March 2021.

Sole proprietorships and companies must have had a drop in revenue of 15 percent or more compared to the revenue before the coronavirus outbreak for the period for which you are applying for a subsidy. For the subsidy period of 15 March to 30 April, the revenue period of 1 March - 30 April 2019 must be compared to the revenue for 1 March - 30 April 2021.

If the enterprise was not established in the corresponding period in 2019 for which you are now applying for a subsidy, or if the enterprise had no revenue in these months, compare the revenue for the subsidy period in 2021 with 1 January – 29 February 2020, that is, the two last months before the coronavirus outbreak.

If the enterprise is a tax-exempt institution or organisation that does not carry out taxable activities, you are not required to have a drop in revenue.

If the enterprise is an institution or organisation that also carries out taxable activities, you may choose to have the subsidy calculated in the same way as for sole proprietorships and companies or as for tax-exempt institutions or organisations.

Tax-exempt institutions and organisations that carry out commercial activity may have a revenue of NOK 70,000 in the income year without incurring tax liability.

The limit is NOK 140,000 for charitable or benevolent institutions. Only institutions with a revenue in excess of these thresholds will fall into this category and thereby be entitled to choose.

The application will be pre-filled with information from the a-melding. It is therefore important that you check that you have reported all the required information, and that the reports are correct.

Incorrect or missing information in your reports in the application month may lead to your application being rejected.

Make sure that:

The enterprise is registered in the Aa Register

The employer must be registered in the State Register of Employers and Employees (Aa Register) with all the relevant information regarding the employees’ employment relationship for the period of May to and including September. You may only apply for subsidies for employees that are registered as laid off in the Aa Register.

Freelancers/contractors (in Norwegian only) and self-employed persons/businesses (in Norwegian only) are not considered employees and should not be registered here. Self-employed persons/businesses may apply on behalf of their employees, but are not considered employees themselves.

You have reported all required information, and the reports are correct

As an employer, you have a duty to report all your employees to the register via the a-melding.

The percentage of employment and the layoff degree must be correct and included in the a-melding before you submit the application.

You can find information about laid-off employees and percentage of employment under the tab “Employment relationship” in the reconciliation report.

If you find errors in your reports, you must correct the errors before you apply for a subsidy.

If you make changes to a-melding(s), you should wait 24 hours before applying, so that the information is registered.

To apply for a subsidy, you must have taken employees who were laid off as at 5 March 2021 fully or partially back to work after 5 March.

The employees may be brought back partially, and they may also be laid off again without loosing earned subsidies. The employees may also be brought back to work again and then qualify for a salary subsidy.

Specific information for enterprises that have employees working in the layoff period

You must ensure that you have reported the correct percentage employment and degree of layoff in the a-melding before applying for a subsidy.

Employees working on an hourly basis

Enterprises with employees who are hired by the hour must convert the hours to a percentage of employment when reporting this information in the a-melding.

Sick leave and other types of absence

The employees' salary costs cannot be covered by the national insurance scheme or other public subsidy schemes. The employees must be brought back to active work. You cannot apply for subsidies for employees who are on sick leave and where the salary costs are covered by the national insurance scheme at the start of the application month.

For employees who remain on a partial sick leave after the employer period, the subsidy amount is reduced accordingly. Nor will a salary subsidy be granted for the days on which the employee is on leave without salary.

You cannot apply for a subsidy for employees who have been brought back to work if you have simultaneously laid off, made redundant or reduced the working hours of other employees who fulfil the same function/perform the same tasks in the application period (for example 15 March to 30 June).

If an employee in a comparable position quits their job, you may apply for a subsidy.

By comparable position, we mean positions that completely or significantly fulfil the same functions. It is up to the employers to consider whether the employees’ positions are comparable, and they must be able to document the employment relationships if they are asked to do so.

Example

The enterprise has stores in Oslo, Bergen and Stavanger. The enterprise brings back all employees to work in all three cities, but then lays off all employees in Oslo in mid-April because of the infection control measures. The enterprise may then apply for a subsidy for the employees who work in Bergen and Stavanger (as well as the employees in Oslo for the period when they were working).

The subsidy will cease if the employee receives less than 80 percent of the calculated subsidy amount as salary for the same period for which you apply for a subsidy.

The same shall apply to commission-based salaries. This will also apply to tax-exempt institutions or organisations.

Example

If the enterprise is paid NOK 50,000 in subsidies for an employee in the subsidy-period 1 May – 30 June, the employee must have been paid at least 80 percent of this amount in the same period, in this case, NOK 40,000.

Specific information for groups

The conditions for receiving a subsidy are the same for groups, but some additional conditions apply:

Groups that apply for a subsidy in this way must include all business entities in the group that are liable to pay tax to Norway, meaning “the Norwegian part of the group”.

Enterprises that are part of the group may send separate applications, or they may send a joint application for the entire group. Enterprises may also send separate applications for one period, and then apply as one group for another period.

If enterprises apply separately for one period and wish to change this to a consolidated group application, each application must be withdrawn and the granted subsidy amount must be repaid before submitting a consolidated group application.

Enterprises that are part of a group of companies could only apply separately if they wished to apply for the subsidy period 15 March to 30 April in the first application period, which was from 3 to 31 May. Now, it is possible to apply for the entire group as if it were one enterprise for the subsidy periods from 15 March to 30 April, and from 1 May to 30 June.

If enterprises apply separately, it is important that all applications from a group of enterprises state the same responsible enterprise in the group.

Consolidated group application

If the group submits a joint application, it must be a consolidated group application. In these cases, the group will be considered to be one enterprise. This only applies to the Norwegian part of the group.

Groups that apply for a subsidy in this way must include all business entities in the group that are liable to pay tax to Norway, meaning "the Norwegian part of the group".

Calculations of the drop in revenue must be made collectively for the Norwegian part of the group. The calculations will be regarded as consolidated as if only these business entities are included in the group, in accordance with the normal principles relating to the consolidation of accounts. Income and costs relating to the group entities that fall outside of the Norwegian part of the group must not be eliminated, but rather, they must be included in the calculation in the same way as income and costs of external entities.

The requirements to apply for a subsidy must be fulfilled for all the enterprises in the Norwegian part of the group. If there are enterprises in the group that do not meet all the requirements to apply for a subsidy, the enterprises must apply separately.

The enterprise that submits the application on behalf of the group will be responsible for the information provided in the application. The enterprise that submits the application must also get consent from all the other enterprises that are part of the Norwegian part of the group. The consent may be given by a person who is eligible to apply for a subsidy on behalf of the enterprise. A subsidy that is granted to the Norwegian part of the group collectively will be granted to and paid out to the company that submits the application.

You may be granted a subsidy for up to 108 days per employee brought back from layoff, and each enterprise may receive up to 21.9 million in salary subsidy for the period of 15 March to 31 August.

- 15 March - 30 April (47 days)

- Enterprise: NOK 39,167 per employee.

- Tax-exempt institutions, organisations and enterprises with apprentices: NOK 23,500 per employee.

- Maximum subsidy amount per enterprise: NOK 9.4 million.

- 1 May – 30 June (60 days)

- Enterprise: NOK 50,000 per employee.

- Tax-exempt institutions, organisations and enterprises with apprentices: NOK 30,000 per employee.

- Maximum subsidy amount per enterprise: NOK 12.5 million.

- 1 July to 31 August (60 days)

- Enterprise: NOK 50,000 per employee

- Tax-exempt institutions, organisations and enterprises with apprentices: NOK 30,000 per employee

- Maximum subsidy amount per enterprise: NOK 12.5 million

The salary subsidy will be reduced automatically when the enterprise has been granted the maximum number of subsidy days per employee. The reduction will be implemented for the most recently submitted application.

Example

The enterprise applies for a salary subsidy for the subsidy periods of 1 May to 30 June and 1 July to 31 August for employees who are eligible for a salary subsidy for all 120 days. The 108-day limit means the enterprise is granted a salary subsidy for 60 days in the subsidy period of 1 May to 30 June and 48 days in the subsidy period of 1 July to 31 August.

The subsidy amount will vary depending on the following:

Employers with a drop in revenue of 70 percent or more in the subsidy-period will be granted a maximum of NOK 25,000 per month per full-time employee that is brought back from leave, which is the equivalent of NOK 833.33 per day.

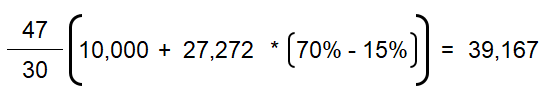

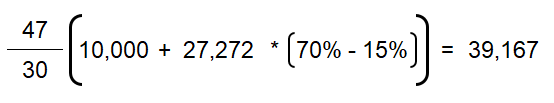

For the subsidy-period 15 March - 30 April (47 days), this amounts to a maximum amount of NOK 39,167.

If the drop in revenue is less than 70 percent, the subsidy amount will be gradually reduced to the minimum subsidy of NOK 10,000 for a drop in revenue of 15 percent.

A drop in revenue of less than 15 percent will not give entitlement to subsidy. A drop in revenue of over 70 percent will entitle the enterprise to the maximum subsidy amount of NOK 833.33 per employee per day.

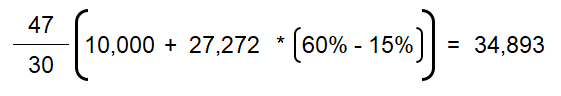

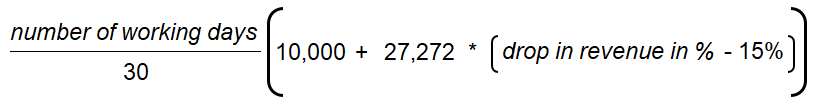

For a drop in revenue between 15 and 70 percent, the subsidy amount is calculated using the following formula:

The constant 27,272 represents the maximum subsidy amount minus the minimum amount divided by the interval for the drop in revenue that gives entitlement for a subsidy (15 – 70 percent).

Roger’s usually works a 100 percent FTE (full-time equivalent) position. He has been laid off since 1 December 2020. The enterprise of which Roger is an employee has a drop in revenue of over 70 percent, and on 15 March, they bring Roger back from leave to his full position.

This means Roger has worked 47 days in the period 15 March – 30 April. The enterprise will be paid NOK 39,167 in salary subsidy for Roger in this subsidy-period based on the following calculation:

If the enterprise of which Roger is an employee has a drop in revenue of 60 percent, the enterprise will be paid NOK 34,893 in salary subsidy for bringing back Roger based on the following calculation:

The subsidy amount will be calculated based on the employee’s percentage of employment set off against the degree of layoff.

Specific information for enterprises that have employees working in the layoff period.

Example

Roger has a position of 50 percent and is brought back from leave to his full position. The enterprise has a drop in revenue of over 70 percent.

The calculation per full-time employee will then be:

The subsidy amount must then be calculated at 50 percent, which is the equivalent to the percentage of employment. The enterprise will receive NOK 39,167 – 50% = NOK 19,583 for the period 15 March - 30 April.

Example

Roger has a position of 50 percent and is brought back from leave to an 80 percent position. The enterprise has a drop in revenue of over 70 percent.

The calculation per full-time employee will then be:

The salary subsidy is first calculated at 50 percent to take Roger’s part-time position into account: 39,167 – 50% = NOK 19,583.

The subsidy amount will then be calculated against the percentage of employment to which the employee is brought back, in this case 80 percent. The enterprise will receive NOK 19,583 x 80% = NOK 15,666 in salary subsidy for the period 15 March - 30 April.

The subsidy will be calculated using an amount per day the employee has worked for the employer in the period.

As working days, we count all days the employee has not been laid off again, been on full or partial sick leave following the employer period, or been on leave without salary. This means weekends and holidays are included in the calculation. If the employee has had any holidays in the subsidy period, the employee must work a corresponding number of days in the period from 1 September to 31 October 2021.

In the event of a partial sick leave, the subsidy amount is reduced accordingly following the employer period.

Example

Roger has a position of 100 percent and is brought back from leave to his full position on 1 April. Due to the new infection control measures in the municipality where he works, Roger is laid off again from and including 16 April and for the foreseeable future.

The enterprise of which Roger is an employee may receive the salary subsidy for every day Roger has worked in the period 15 March – 30 April.

In this case, this means the enterprise will receive the salary subsidy for 15 days. That means NOK 833.33 per day = NOK 12,499.95 as the total subsidy amount for the period.

If the enterprise is a tax-exempt institution or organisation that does not carry out taxable activities, you are not required to provide the enterprise’s revenue.

In these cases, a subsidy of NOK 15,000 per monthly full-time employee is granted.

If the enterprise is an institution or organisation that also carries out taxable activities, you may choose to have the subsidy calculated in the same way as for sole proprietorships and companies or as for tax-exempt institutions or organisations.

Tax-exempt institutions and organisations that carry out commercial activity may have a revenue of NOK 70,000 in the income year without incurring tax liability. The limit is NOK 140,000 for charitable or benevolent institutions.

Only institutions with a revenue in excess of these thresholds will fall into this category and thereby be entitled to choose.

Example

Roger works in a voluntary organisation that does not carry out taxable activity. He has been laid off since the middle of November 2020, and on 15 March, Roger is brought back from leave to his full position. The organisation may then receive NOK 15,000 per month to bring back Roger from leave, which will amount to NOK 500 per day. For the period 15 March – 30 April, this is NOK 23,500.

The subsidy amount will be calculated based on the employee’s percentage of employment set off against the degree of layoff.

Example

Roger has a position of 60 percent with the voluntary organisation. He is laid off 100 percent, and on 15 March, the layoff is reduced to 50 percent. The subsidy amount will then be calculated against a position of 60 percent. This means NOK 23,500 x 60 percent position = NOK 14,100.

This must then be calculated set off against 50 percent reduced layoff degree. This means NOK 14,100 x 50% layoff degree = NOK 7,050 in salary subsidy for the period 15 March – 30 April, which amounts to NOK 150 per day.

Roger is laid off again after 10 days back at work. The enterprise will then receive a salary subsidy for the 10 days he has been back to work in the period March - April.

In this case, the enterprise will receive NOK 150 per day x 10 days = NOK 1,500 in salary subsidy for Roger in this period.

The subsidy amount for each employee may not exceed 125 percent of the salary before the layoff.

Example

Roger has a full-time position in a voluntary organisation, and he is paid a salary of NOK 10,000 per month. For the period 15 March – 30 April (47 days), this is the equivalent of NOK 15,667 in salary.

The organisation brings Roger fully back to work on 15 March 2021, and he works every day in the period March – April.

Since the salary subsidy of NOK 23,500 exceeds 125 percent of Roger’s salary, the subsidy amount will be limited to 125 percent of Roger’s salary before the layoff, which was NOK 15,667 calculated for 47 days.

The enterprise will receive NOK 15,667 x 125% = NOK 19,584 for the period, or NOK 416.67 per day.

You must contact us if you have discovered errors/missings or have questions.

If you believe the decision you received is incorrect, you may appeal the decision within six weeks of receiving the letter with the decision.

The overview of which enterprises have been allocated money is updated daily.