Changing payroll system

If you change your payroll system, all the information concerning the employment relationships must be transferred to the new system.

Make sure that

When you change your payroll system, or change from sumbitted the a-melding from skatteetaten.no or Altinn (A01) to a payroll system, you must transfer the employment information from one system to another. If you change your accountant, you will probably also have to change your payroll system.

You must then make sure that

- you continue to report the employments each month until the employment relationships are terminated

- the employees have the same number of employment relationships after you have changed systems

- employment relationships are linked to the same enterprise in the old and the new system.

NB!

You can check how the employment relationships are specified in the last month. Order a reconciliation report with employee information for a month.

You can not sumbitt a-meldings with the same employments from two different systems for the same periode.

You can specify employment relationships in one of three ways when you switch system

- If you use a payroll system, check with your system supplier if you are not sure how to make changes.

- If you are switching from direct registration at skatteetaten.no or Altinn (A01) to a payroll system, you must choose either alternative 2 or 3

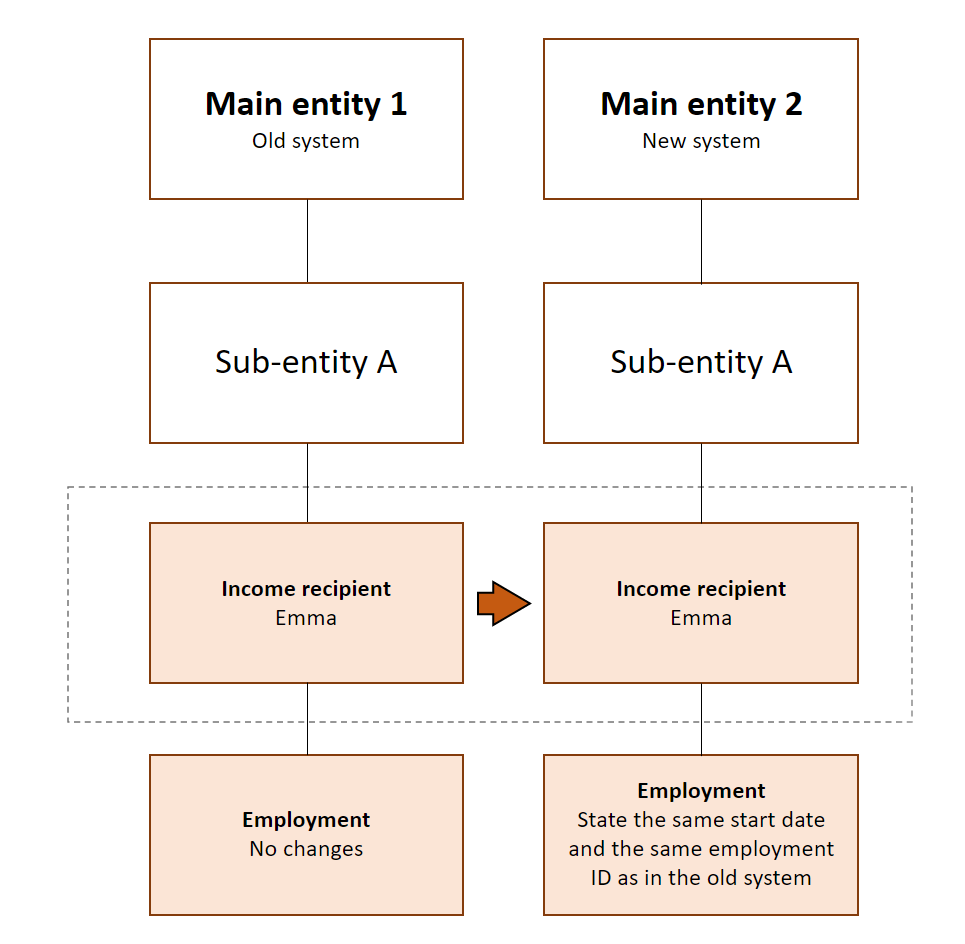

Alternative 1 - carry over employment from the old system to the new system

With this method you do not terminate the employments, or change the information about the employments, in the old system.

When you submit the a-melding from the new system, you must use the same organisation number for the sub-entity, type of employment, employment ID and start date as in the old system, in the new system.

For employees who are on leave or laid off, also use the same description, ID and start date for the leave or layoff as in the old system.

Example

Emma began working for sub-entity A on 10 October. She is registered with employment ID: 10. They replace their payroll system on 20 May.

| A-melding for May Old payroll system |

|

| Sub-entity | A |

| Income recipient | Emma |

| Employment ID | 10 |

| Employment type | Ordinary |

| Employment start date | 10 October |

| Employment end date | |

They also enter the other mandatory information.

| New payroll system | |

| Sub-entity | A |

| Income recipient | Emma |

| Employment ID | 10 |

| Employment type | Ordinary |

| Employment start date | 10 October |

| Employment end date | |

They also enter the other mandatory information.

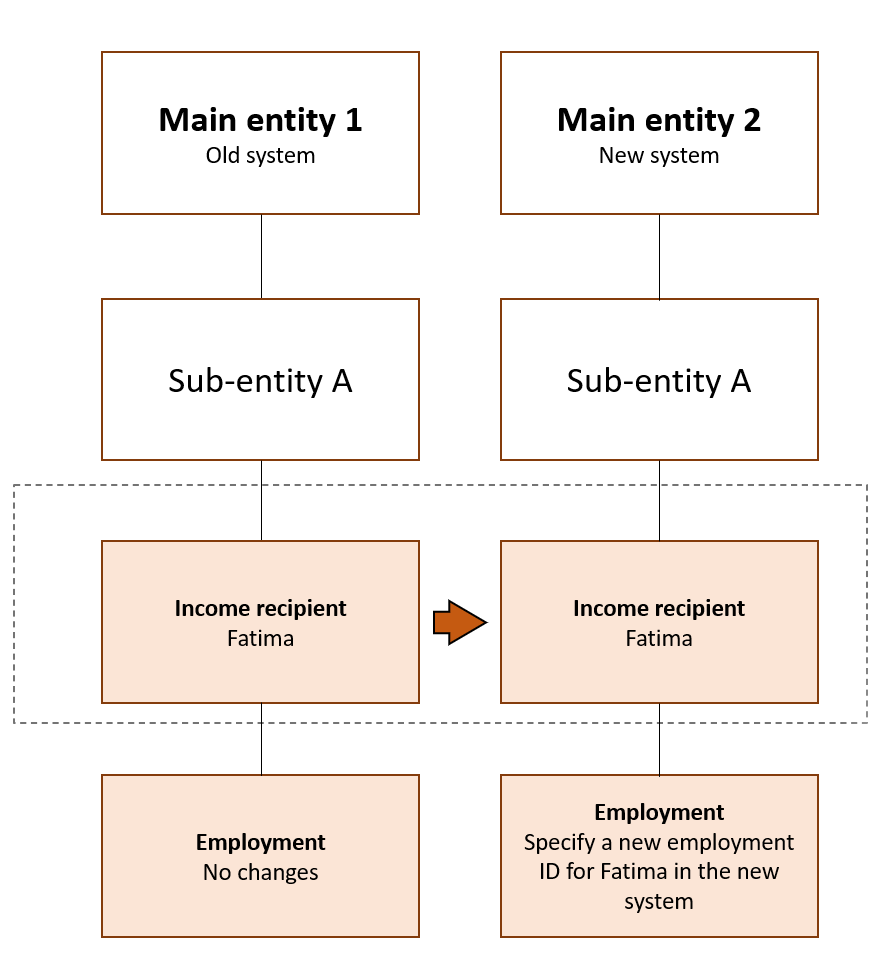

Alternative 2 - do not terminate the employment in the old system

With this method you do not terminate the employments, or change the information about the employments, in the old system.

When you submit the a-melding from the new system, you must specify a new employment ID, and retain the same employment type and start date as in the old system.

For employees who are on leave or laid off, state the end date of the leave or layoff in the old system and create a new leave or layoff in the new system. Make sure you set the start date to the day after the end date which is specified in the old system.

Use the same organisation number for the sub-entity in both the new and the old systems.

Example

Fatima started work for sub-entity A on 10 October. She is registered with employment ID: 1. They replace their payroll system on 20 May.

| A-melding for May Old payroll system/A01 |

|

| Sub-entity | A |

| Income recipient | Fatima |

| Employment ID | 1 |

| Employment type | Ordinary |

| Employment start date | 10 October |

| Employment end date | |

They also enter the other mandatory information.

|

A-melding for June |

|

| Sub-entity | A |

| Income recipient | Fatima |

| Employment ID | 2 |

| Employment type | Ordinary |

| Employment start date | 10 October |

| Employment end date | |

They also enter the other mandatory information.

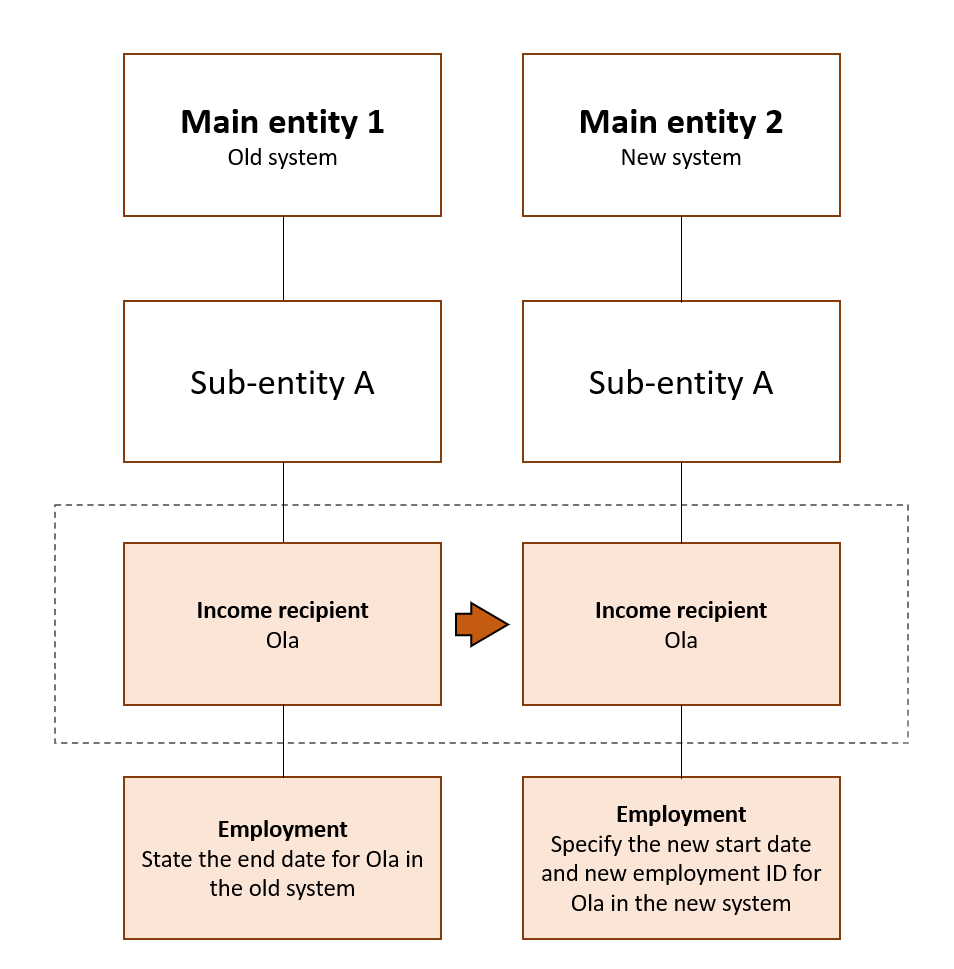

Alternative 3 - terminate the employment in the old system

When you use this method you submit an a-melding from the old system and terminate the employment by stating employment end date and cause of end date. You state changed payroll system or accountant as cause of end date.

You submit an a-melding from the new system with new employment IDs. Make sure you set the start date to the day after the end date which is specified in the old system.

For employees who are on leave or laid off, state the end date of the leave or layoff in the old system and create a new ID and start date for the leave or layoff. Make sure you set the start date to the day after the end date which is specified in the old system.

Use the same organisation number for the sub-entity in both the new and the old systems.

Example

Ola started work for sub-entity A on 10 October. He is registered with employment ID 1. You replace your payroll system on 20 May.

| A-melding for May Old payroll system/A01 |

|

| Sub-entity | A |

| Income recipient | Ola |

| Employment ID | 1 |

| Employment type | Ordinary |

| Employment start date | 10 October |

| Employment end date | 19 May |

| Cause of end date | Changed payroll system or accountant |

They also enter the other mandatory information.

| New payroll system | |

| Sub-entity | A |

| Income recipient | Ola |

| Employment ID | 2 |

| Employment type | Ordinary |

| Employment start date | 20 May |

| Employment end date | |

They also enter the other mandatory information.