Organisation number for main entity and for sub-entities

Which organisation numbers should you use in the a-melding?

From 2023, the a-ordning, vil stop using the terms legal entity's organisation number and enterprise number. The declarants legal entity is now referred to as the main entity end the enterprise they run is referred to as the sub-entity.

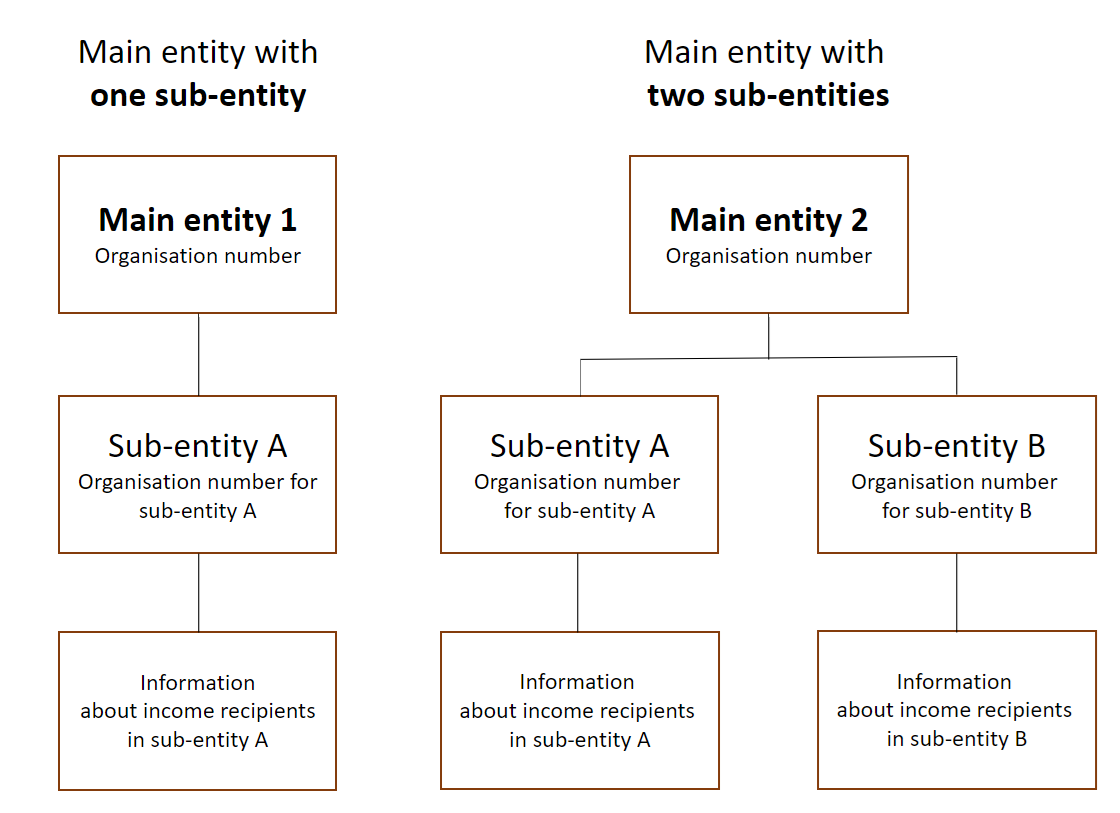

Use two organisation numbers to identify the party for which you are submitting the a-melding

In the a-melding, you identify the entity for whom you’re submitting the a-melding by stating the main entity's organisation number. A main entity is a collective term for companies, associations, persons and others registered in the Central Coordinating Register for Legal Entities, and which is not a sub-entity. The main entity is an enterprise at the highest level in the registration structure in the Central Coordinating Register for Legal Entities. The main entity is the subject to the reporting obligation in the a-ordning scheme.

If you have employees, you must also state the organisation number for the sub-entity. The sub-entity defines the activity operated by the main entity. A main entity can have one or several sub-entities. The sub-entities are not independent enterprises. They will always be connected to a main entity. A sub-entity is an enterprise at the lowest level in the registration structure in the Central Coordinating Register for Legal Entities. State the sub-entity's organisation number when reporting information about employment, income, deductions and employer's national insurance contributions.

If you only state the type of employment as pension or work without employment, or you do not state the employment at all, you can state the organisation for the main entity when specifying the sub-entity level in the a-melding.

Main entity

State the organisation number of the main entity in order to identify the party for which you are submitting the a-melding. This also applies to sole proprietorships.

All enterprises and associations that register in the Register of Legal Entities are assigned an organisation number. The entity that is identified by this organisation number is known as the main entity. The main entity is the declarant in the a-melding.

Don’t have a an organisation number? See the Brønnøysund Register Centrer and altinn.no for more information and application form.

Private individuals must use their national identity number

If you submit an a-melding as a private individual, you must use your national identity number in order to identify the declarant.

Sub-entity

State the organisation number for the sub-entity and link the employees to the sub-entity they work for.

Everyone who operates commercially and/or has employees, must have at least one sub-entity, identified by an organisation number for the sub-entity. The sub-entity is not independent. It must always be linked to a main entity. Under a main entity, there can be one or more sub-entities.

Make sure that the registration in the Register of Legal Entities is correct and report according to the same structure in the a-melding. Complete the registration in the Register of Legal Entities before you submit an a-melding.

Don't have an organisation number for the sub-entity? See the Brønnøysund Register Centrer and altinn.no for more information and an application form.

How to find the organisation number for your sub-entity

Most people engaged in business activity are assigned both an organisation number for the main entity and for the sub-entity. On the website for the Brønnøysund Register Centre you can find the organisation number for your sub-entity. Enter the main entity's organisation number in the field Find enterprise/company. At the bottom of the next page (the search result), you’ll find a link to the page which shows the sub-entity registered under the main entity.

Not yet been assigned an organisation number for the sub-entity

If you've applied for an organisation number for the sub-entity in the Register of Legal Entities, and you've not received it by the deadline for submitting the a-melding, you must delay the submission until you've been assigned the organisation number.

Once you have received an organisation number for the sub-entity, you must use this number instead.

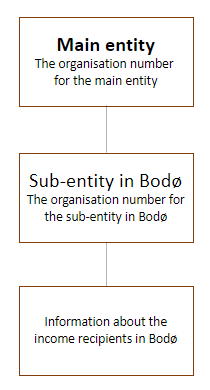

Example with one sub-entity

A hair salon that intends to run a business in Bodø has registered in the Register of Legal Entities. It has been assigned an organisation number for the main entity and an organisation number for the sub-entity in Bodø.

The salon specifies the main entity's organisation number in order to identify the declarant in the a-melding.

It also states the organisation number for the sub-entity in Bodø and links information concerning the employees to this number.

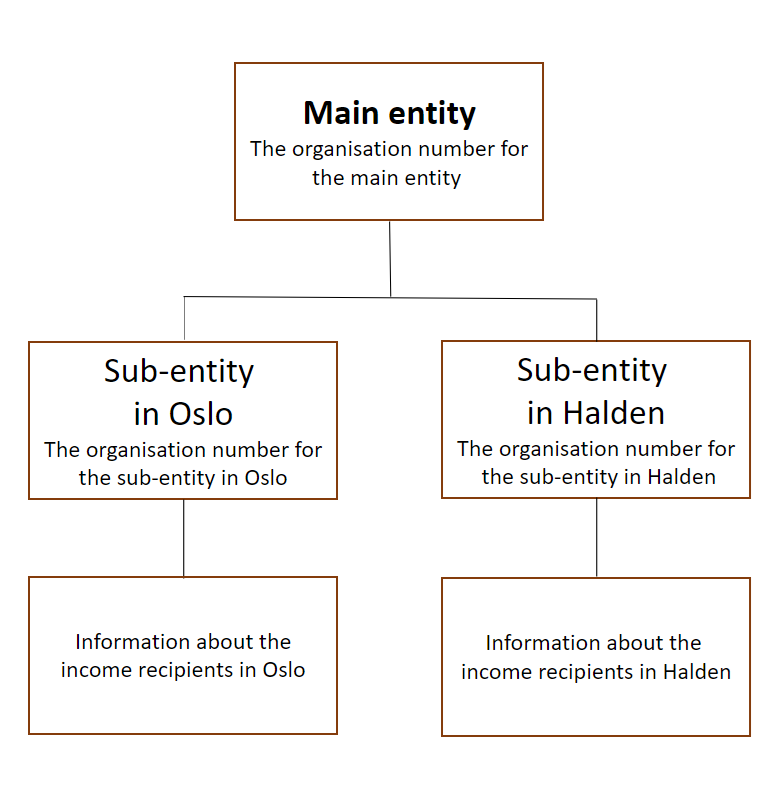

Example with several sub-entities

A plumbing firm that intends to run a business in both Oslo and Halden has registered in the Register of Legal Entities. The firm has been assigned an organisation number for the main entity and two organisation numbers for the sub-entities, one for Oslo and one for Halden.

The plumbing firm specifies the organisation number for the main entity in order to identify the declarant when it submits a-meldings for Oslo and Halden.

It also states the organisation number for the sub-entity in Oslo and links information concerning the employees in Oslo to this number.

Correspondingly, it also states the organisation number for the sub-entity in Halden and links information concerning the employees in Halden to this number.

The firm reports information for both sub-entities in the same a-melding (recommended). It can also report information for the sub-entity in Oslo in one a-melding and information for the sub-entity in Halden in another a-melding.

Organisation number and employment information in the event of merger, divestment, etc.

Acquisition, change of owner or transfer of enterprise

Correcting errors

|

Error messages concerning organisation number for the main entity |

| MAGNET-000005 Invalid ID for declarant |

| MAGNET-000096 Invalid ID for declarant |

| MAGNET_EDAG-109A Differs from information in the Register of Legal Entities |

| MAGNET_EDAG-182 The declarant’s organisation number in the a-melding is different from the organisation number reported for in Altinn |

|

Error messages concerning organisation number for sub-entities |

| MAGNET_EDAG-107B Invalid identifier for the enterprise |

| MAGNET_EDAG-142 Information in the a-melding does not correspond with the information in the Register of Legal Entities |

| MAGNET_EDAG-142B Information in the a-melding does not correspond with the information in the Register of Legal Entities |

| MAGNET_EDAG-142C Information in the a-melding does not correspond with the information in the Register of Legal Entities |

| MAGNET_EDAG-196 Information in the a-melding does not correspond with the information in the Register of Legal Entities |

| MAGNET_EDAG-255 Incorrect reporting of enterprise |

| MAGNET_EDAG-288 Invalid identifier for the enterprise |

| MAGNET _EDAG-289 Invalid identifier for the enterprise |

Errors concerning organisation number for the main entity

If you have specified the wrong organisation number for the main entity, but not received an error message concerning this in the feedback (A03), you must delete all the information that you have submitted for this number.

You do this by submitting an empty replacement a-melding. You must also submit the information under the correct organisation number for the main entity.

Example use of an incorrect organisation number

When she submitted an a-melding, Kari mistakenly used her own national identity number instead of the organisation number to the main entity.

To correct the error, Kari first submits an empty a-melding under her national identity number in order to replace the a-melding that she submitted with the wrong number.

She then submits a new a-melding with the organisation number of the main entity for which she is reporting.

| Empty a-melding | |

| Declarant | National identity number |

| Message ID | 2 |

| Replaces message ID | 1 |

No other information.

| New a-melding | |

| Declarant | Organisation number for main entity |

| Message ID | 1 |

It also enters the other obligatory information.

Error concerning organisation number for sub-entities

If you have specified an incorrect organisation number for an sub-entity and not received an error message concerning this in the feedback (A03), you will have to move the employee to the correct number.

To correct the error, you must first submit an empty a-melding with the organisation number for the sub-entity that is incorrect. You then submit a new a-melding with the correct organisation number for the main entity and organisation number for the sub-entity.

If you use a payroll system, please contact your system supplier if you are unsure how to correct reporting in your system.

What do we use the information for

All information in the a-melding is linked to an organisation number or an organisation number for organisational link, se Organisation number in the public sector. This is used when information in the a-melding is distributed to NAV, Statistics Norway and the Norwegian Tax Administration.

Information on organisation number for sub-entites is transferred to the Aa Register together with employment information. The Aa Register contains an overview of the employees of each individual sub-entity.

Public authorities such as NAV, Statistics Norway, the Norwegian Labour Inspection Authority and the police agency use information from the Aa Register to fulfil their remit and perform checks.

Applicable regulations

These regulations are only available in Norwegian.