Acquisition, change of owner or transfer of enterprise

Both the existing and new owners must ensure that the information concerning the employment relationships is linked to the correct enterprise.

The acquisition, change of owner or transfer of enterprise means that all or part of an enterprise is sold/transferred from the current owner to a new owner.

What you have to do

- The current owner specifies the end date and cause of end date for the employment relationships

- New owner specifies a start date for the new employment relationships

The current owner specifies the end date and cause of end date for the employment relationships

As the current owner of the enterprise, you must specify an end date and cause of end date for all the employment relationships for the employees concerned.

Example

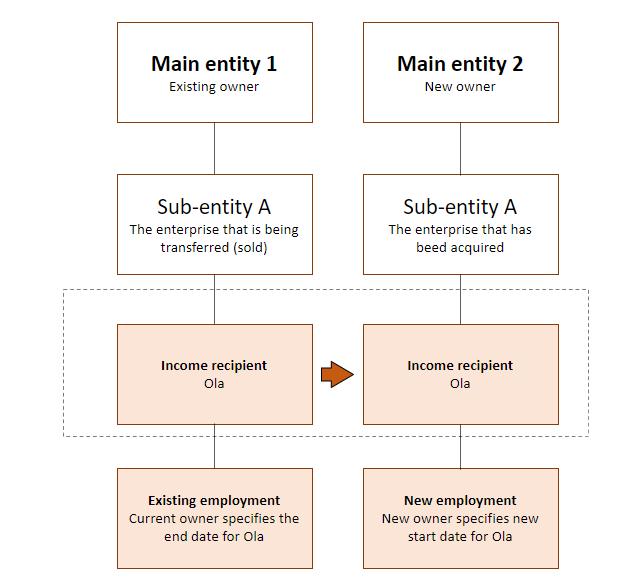

The current main entity 1 must terminate all employment relationships because the enterprise has been acquired by main entity 2. Main entity 2 takes over from 1 June.

| A-melding for May | |

| Main entity | 1 |

| Sub-entity | A |

| Income recipient | Ola |

| Employment start date | 1 January |

| Employment end date | 31 May |

| Cause of end date | Changes in organisational structure or internal job swap |

They also enter the other mandatory information

New owner specifies a start date for the new employment relationships

As the new owner of the enterprise, you must specify all the employment relationships for the employees for whom you take over employer responsibility under the new main entity. For a more detailed explanation of the information that you must provide, see the various types of employment.

Note!

The new start date for the employment must be the day after the end date, in order for the information in NAV’s Aa Register to be correct. For example, end date of 31 December and start date of 1 January.

Example - Transfer of enterprise, entire enterprise

The new owner main entity 2 must specify all employment relationships from the date on which he takes over employer responsibility because they have bought out main entity 1. Main entity 2 takes over from 1 June.

| A-melding for June | |

| Main entity | 2 |

| Sub-entity | A |

| Income recipient | Ola |

| Employment start date | 1 June |

| Employment end date | |

They also enter the other mandatory information.

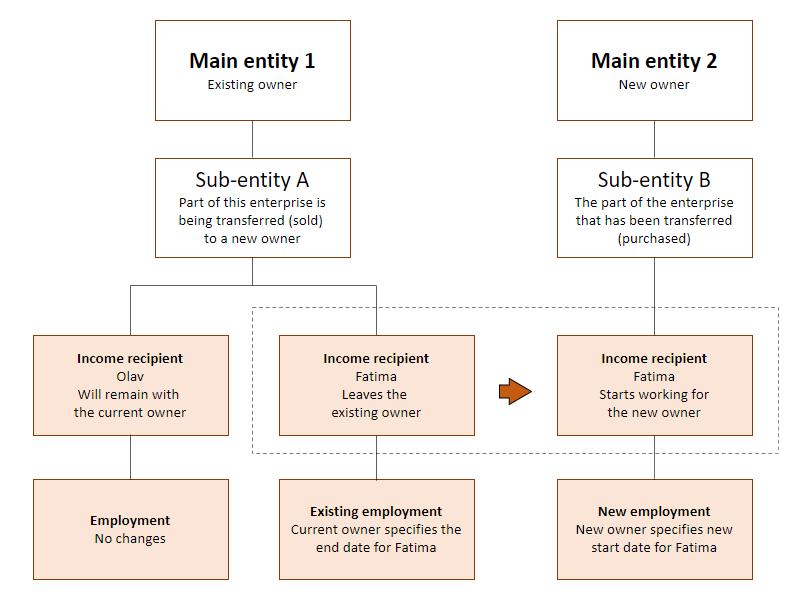

Example - transfer of enterprise, part of enterprise

The new owner, main entity 2, must specify all employment relationships from the date on which he takes over employer responsibility because they have bought out main entityr 1. Main entity 2 takes over from 1 June.

| A-melding for June | |

| Main entity | 2 |

| Sub-entity | B |

| Income recipient | Fatima |

| Employment start date | 1 June |

| Employment end date | |

They also enter the other mandatory information.

Establishing a main entity in order to take over one or more sub-entities at a later date

If a main entity is established in order for this entity to take over one or more sub-entities at a later date, this main enity will not be issued an organisation number. If there are employees in the main entity working on the transfer, their salaries must be included in the a-melding, and the employment type must be Pensions or other benefits, or their salaries must be reported without including information about the employment type. Only when the main entity has taken over the sub-entities should the employment type be changed to ordinary, maritime or freelancer.

Example - Future transfer of enterprise

Main entity 1 sells sporting goods and has 2 shops in different towns. The owner of the shops has become ill and wants to sell both shops. He contacts Per, who is considering whether to buy the shops.

Per establishes a main entity, main entity 2, in February, and he’s working on the conditions to transfer the 2 shops over the next few months. On 1 April, he takes over the shops, and he starts working in one of them (sub-entity A).

| A-melding for February and March | |

| Main entity | 2 |

| Sub-entity | |

| Income recipient | Per |

| Employment type | Pensions or benefits not related to employment |

They also enter other mandatory information.

| A-melding for April | |

| Main entity | 2 |

| Sub-entity | A |

| Income recipient | Per |

| Employment type | Ordinary |

| Employment start date | 1 February |

| Employment end date | |

They also enter other mandatory information.