New job in another sub-entity with the same employer

Set the end date of the employment and the cause for the end date in the existing sub-entity and create a new employment relationship with a new start date in the new sub-entity.

This concerns the situation when an employee moves permanently from one sub-entity to another but remains with the same employer. It also applies if the employee gets a temporary position in another sub-entity, but remains with the same employer.

An employment relationship can only be linked to one sub-unit.

What you have to do

If one of your employees changes job internally, from one sub-entity to another, you must:

- Terminate the employment with the original sub-entity by reporting an end date and cause of end date.

- Report a new employment in the new sub-entity with a new start date.

- Check whether you need to change any other information concerning the employment.

This applies to information concerning: - Occupation code

- No. of hours per week to which a full-time position equates

- Percentage employment (FTE percentage)

- Most recent date of change in percentage employment

- Working hours arrangement

- Most recent salary change date

- Type of appointment

- Wage seniority

- Pay grade

- Information on leave or vessels

- Check whether there will be any changes to employer's National Insurance contributions. When an employee transfers from one enterprise to another but remains with the same employer, the employer’s National Insurance contributions may change. This applies when the enterprises are in different employer’s National Insurance contribution zones.

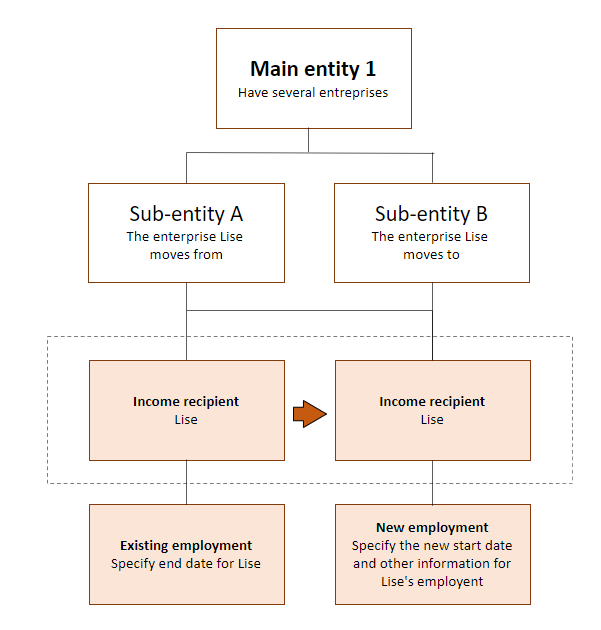

Example – gets a temporary position in another sub-entity

Main entity 1 has two enterprises, sub-entity A and sub-entity B. Lise has worked as a sales consultant for sub-entity A since 1 February. From 10 August, Lise will become the general manager for sub-entity B.

They must terminate Lise’s employment with sub-entity A and create a new employment for her in sub-entity B. They must do this in the a-melding for August.

| A-melding for August | |

| Main entity | 1 |

| Sub-entity | A |

| Income recipient | Lise |

| Employment ID | 10 |

| Employment start date | 1 February |

| Employment end date | 9 August |

| Cause of end date | Changes in organisational structure or internal job swap |

| Sub-entity | B |

| Income recipient | Lise |

| Employment ID | 10 |

| Employment start date | 10 August |

| Employment end date |

They also enter the other mandatory information.

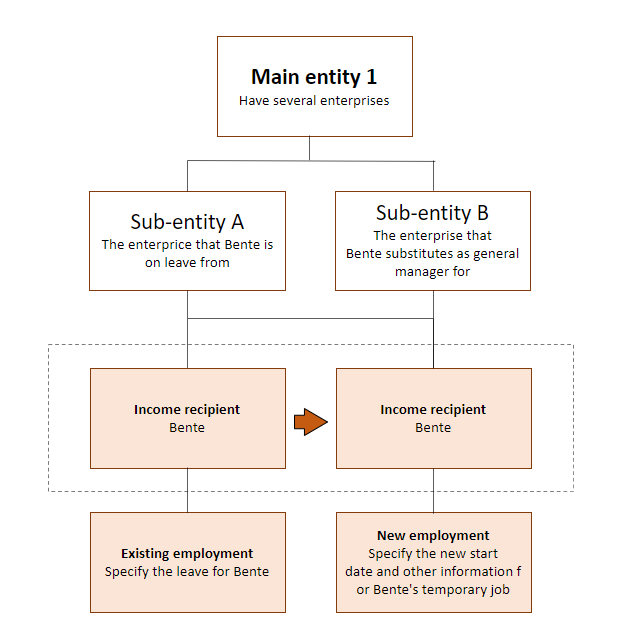

Example – gets a temporary position in another sub-entity

Main entity 1 has two enterprises, sub-entity A and sub-entity B. Bente has a permanent position as sales consultant in sub-entity A, where she has worked for many years. From 10 August, Bente will function as the general manager for sub-entity B. The temporary position has a duration of 10 months. After this, she will return to her permanent position in sub-entity A.

They must terminate Bente’s employment with sub-entity A and create a new employment for her in sub-entity B. This must be registered in the a-melding for August.

| A-melding for August: | |

| Main entity | 1 |

| Sub-entity | A |

| Income recipient | Bente |

| Employment ID | 19 |

| Employment start date | 1 February |

| Employment end date | |

| Cause of end date | |

| Description of leave | Other non-statutory leaves |

| Leave ID | 2 |

| Start date of leave | 10 August |

| End date of leave | 10 June |

| Sub-entity | B |

| Income recipient | Bente |

| Employment ID | 25 |

| Employment start date | 10 August |

| Employment end date | |

They also enter other mandatory information.