Allocating spouses’ income from joint business

Spouses, registered partners and spouse-equivalent cohabitants may share income from a joint business between themselves. Both of you must have worked in the business in the income year.

If you own the business together, it’s considered a joint business. A business owned by one spouse may also be considered a joint business for tax purposes.

How to share the income

Spouses divide income from a joint business according to their respective work effort invested in the business in the income year.

In the overall assessment, you must take into account both the quality and the amount of your work.

- If you’ve contributed approximately the same work effort to the joint business, it may be appropriate to share the income equally.

- If one spouse has only performed dependant or subordinate work, he or she cannot be allocated a larger share of the income than it would have cost the business to hire an outside worker to do the work.

If the profit allows for no more than a reasonable remuneration for your work input, you can share the entire profit according to your work input.

How to enter this in your tax returns

Follow the directions in your accounting system. Contact the system provider if you have any questions.

If you’re submitting the new tax return, the one considered the main practitioner must add the business information to his or her tax return. Read more about the tax return with business information.

The other person only has to submit the normal tax return, but must state his or her share of the personal income.

Watch a video with examples of how spouses can allocate business income from a joint business:

How to enter the information:

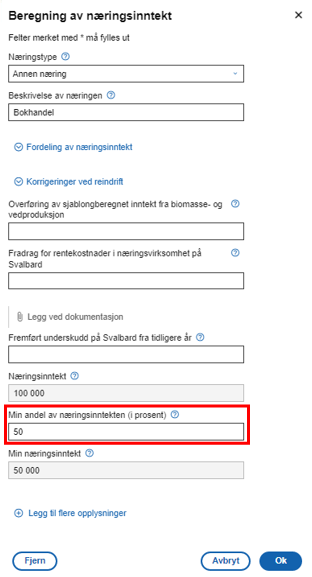

The one considered the main practitioner must register the share of business income or a deficit in the business information under

- “Allocated calculated business income”

- “Calculation of business income”

- “My share of the business income”

Register the percentage of the share.

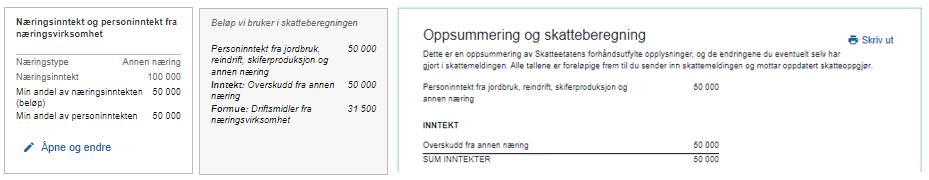

The allocation of business and personal income is shown under the summary of the business information and under the topic “Business” in the tax return.

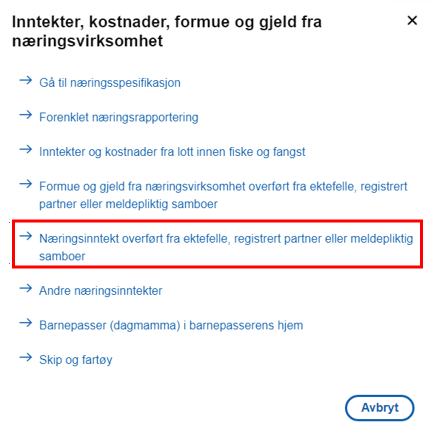

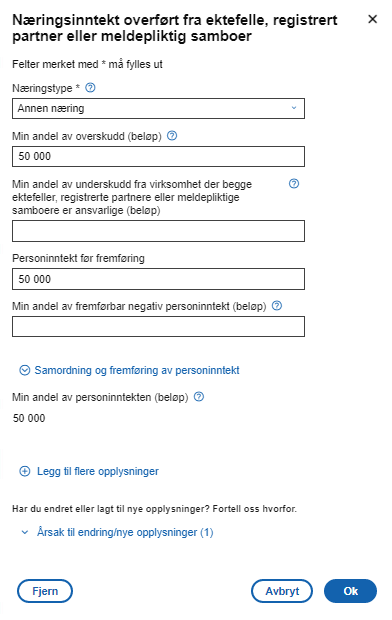

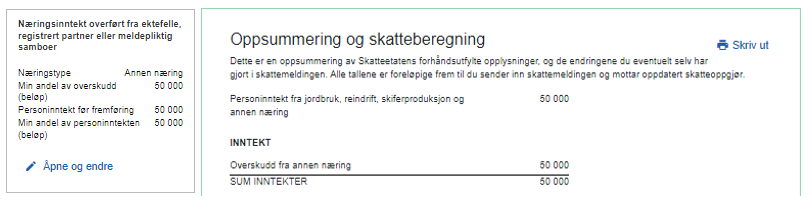

The other spouse states his or her share of the business and personal income in the tax return under

- «Business»

- “Income, expenses, wealth and debt from business activity”

- “Business income transferred from spouse, registered partner or spouse-equivalent cohabitant”

When you’ve entered the amount, it will be shown under the topic “Business” and in the summary of your tax return.

Interest expenses and share dividends

By applying the same method used for sharing profits, interest expenses in a joint business are shared between spouses in the business information or the income statement.

If necessary, one of you must correct the interest that has been pre-completed in the tax return.

Spouses must also share interest income, share dividends and similar that are posted in the joint business and report them in the business information or the income statement.

Sharing losses

You cannot share losses from a joint business unless both are responsible. The responsible owner of the business reports the entire loss in their tax return.