Introduction of excise duty on power (high-price contribution)

Here you’ll find details about the introduction of excise duty on power (high-price contribution).

- Starting from 28 September 2022, an excise duty has been introduced for large hydropower plants, a high-price contribution, at 23 percent of the price that exceeds NOK 0.70 per kWh. By large hydropower plants, we mean hydropower plants that own generators with a rated power output of 10,000 kVA or more.

- From and including 1 January 2023, the excise duty also includes income from power produced in hydropower plants with an installed effect of at least 1 MW, and income from power produced in wind energy farms subject to licensing.

The duty has been introduced as a result of the exceptionally high prices on electricity in some parts of southern Norway. The duty will ensure the redistribution of more of the exceptional income from power production.

Read more about the background for the excise duty (in Norwegian only):

1. About the excise duty

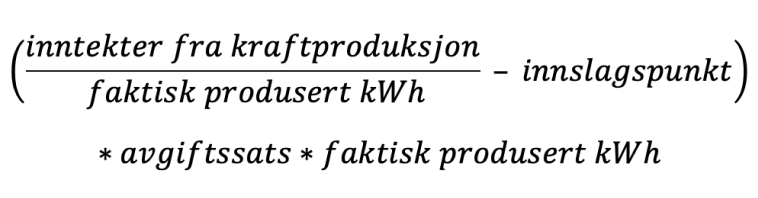

The excise duty is 23 percent of the average monthly price exceeding NOK 0.70 per kWh. The average price is calculated on the basis of income from power production per month, divided by the power production in the same month. The basis for the duty is the portion of the power price that exceeds NOK 0.70 per kWh.

The duty is calculated using the following formula:

Production covered by contract exemption in the ground rent tax and other agreements of actual supply of a fixed volume at a fixed price, is valued at the contract price. Income from other activity than power production is excluded from the excise duty basis. See more under point 3 below about financial contracts concluded no later than 27 September 2022.

The duty is calculated separately for power valued at the spot market price, licence power, power in accordance with withdrawal rights, and own power. Other contracts and agreements relating to power are calculated as one. If the enterprise subject to excise duty owns several power plants in different pricing areas, the calculation is made per pricing area and then aggregated for the enterprise. The volumes are allocated to the pricing area where the power has been supplied.

2. About licence power, withdrawal rights, own power, and pump power

The power plant owner is subject to excise duty for license power. Sold licence power is valued at the achieved price. The same applies to power sold to parties with withdrawal rights. Power used in own business activity is valued at spot market price.

For power that is used to pump water back up to the reservoirs (pump power), the cost is distributed evenly for the total production in the excise duty period and subtracted from income in the power production.

3. Specific information about contracts concluded no later than 27 September 2022

Enterprises that have concluded financial contracts no later than 27 September 2022, to ensure income from sales to spot market price, may adjust the excise duty basis with gain and loss from such contracts. By financial contracts, we mean contracts where power is the underlying object, and that are concluded for the securing of income from power production for the area where the power has been supplied or against the Nordic system price for power. The condition for such adjustments is that the contract is in keeping with the actual production volume in the same pricing area, or against the Nordic system price, in the corresponding period. Gain or loss is calculated as the difference between the contract’s agreed price and the contract’s reference price for secured production volume.

If the secured volume is lower than the production in the relevant pricing area and in the relevant period, the exceeding production volume is not adjusted with gain or loss. If the secured volume exceeds the production in the relevant pricing area and in the relevant period, the secured volume is distributed in accordance with a volume weighted average of the contract prices.

In the event of security against the system price, any production in other Nordic countries must be taken into consideration when distributing the secured volume.

If the excise duty calculation is adjusted by gain and loss according to this provision, it must be implemented for all financial contracts that meet the conditions for financial contracts under this provision and for all tax periods.

No adjustment for gain or loss is allowed for financial contracts that are concluded on 28 September 2022 or later.

The rules regarding treatment of financial contracts for excise duty purposes are described in detail in section 3-28-4 of the Excise Duty Regulation..

4. Commonality of interest

For contracts concluded after 27 September 2022 between the registered enterprise and a company, facility, or person with a commonality of interest, the spot market price must be used when calculating excise duty. This does not apply if it’s possible to document that the actual price agreed in the contract reflects market price. If such contracts have been concluded before 28 September 2022, the agreed price is the basis for the excise duty calculation.

5. The right to deductions from other tax bases

The high-price contributions cannot be deducted when calculating the basis for ground rent tax and property tax. The excise duty is not an operating expense that normally follows from power production according to the deduction rules in section 18-3, subsection 3, letter a, no. 1, of the Taxation Act. Neither is the excise duty deductible in the basis for company tax, see section 6-15, third sentence, of the Taxation Act.

6. What registered enterprises must do

Enterprises with an obligation to register for the excise duty are owners and renters of excise duty liable hydropower plants or wind energy farms, and participants in production communities which, according to section 2-2, subsection 2, of the Taxation Act, are not separate taxable entities.

The reporting and payment of excise duties to the state, will be carried out through self-assessment. It’s the enterprise with an obligation to register that must assess and calculate the basis for the excise duty. The basis for the duty is reported in the tax return for excise duties.

7. Submit the excise tax return

For the start-up year 2022, an annual taxation period has been decided, and this includes excise tax that accrues from and including 28 September to and including 31 December 2022. The tax return for excise duty for 2022 must be submitted no later than 18 January 2023. For 2023, the taxation period is monthly. The tax return must be submitted no later than the 18th of the month after the taxation period. The submission deadline for the first tax return for 2023 is 18 February.

You’ll find guidance, information, and links to submission here:

Legal sources

Useful legal sources in connection with the introduction of the excise duty on power production:

- The Proposition to the Storting on taxes, duties, and customs duties (Prop. 1 LS) 2022–2023

- Some clarifications in connection with high-price contributions (in Norwegian only)

- The Storting Resolution on excise duties for the 2023 budget year (in Norwegian only)

- The Excise Duties Regulation, chapter 3-28 (in Norwegian only)

- Annual circular regarding the excise duty on power production for 2023 (in Norwegian only)