All people will receive the new tax return

All wage earners and pensioners will receive the new version of the tax return.

The tax return will be available on different dates. You’ll be notified by the Tax Administration when yours is ready to be checked.

How the new tax return works

The new tax return is still pre-filled with information, but it has a new design and is easier to use. The most important thing is that you continue to check, change or add information to your tax return.

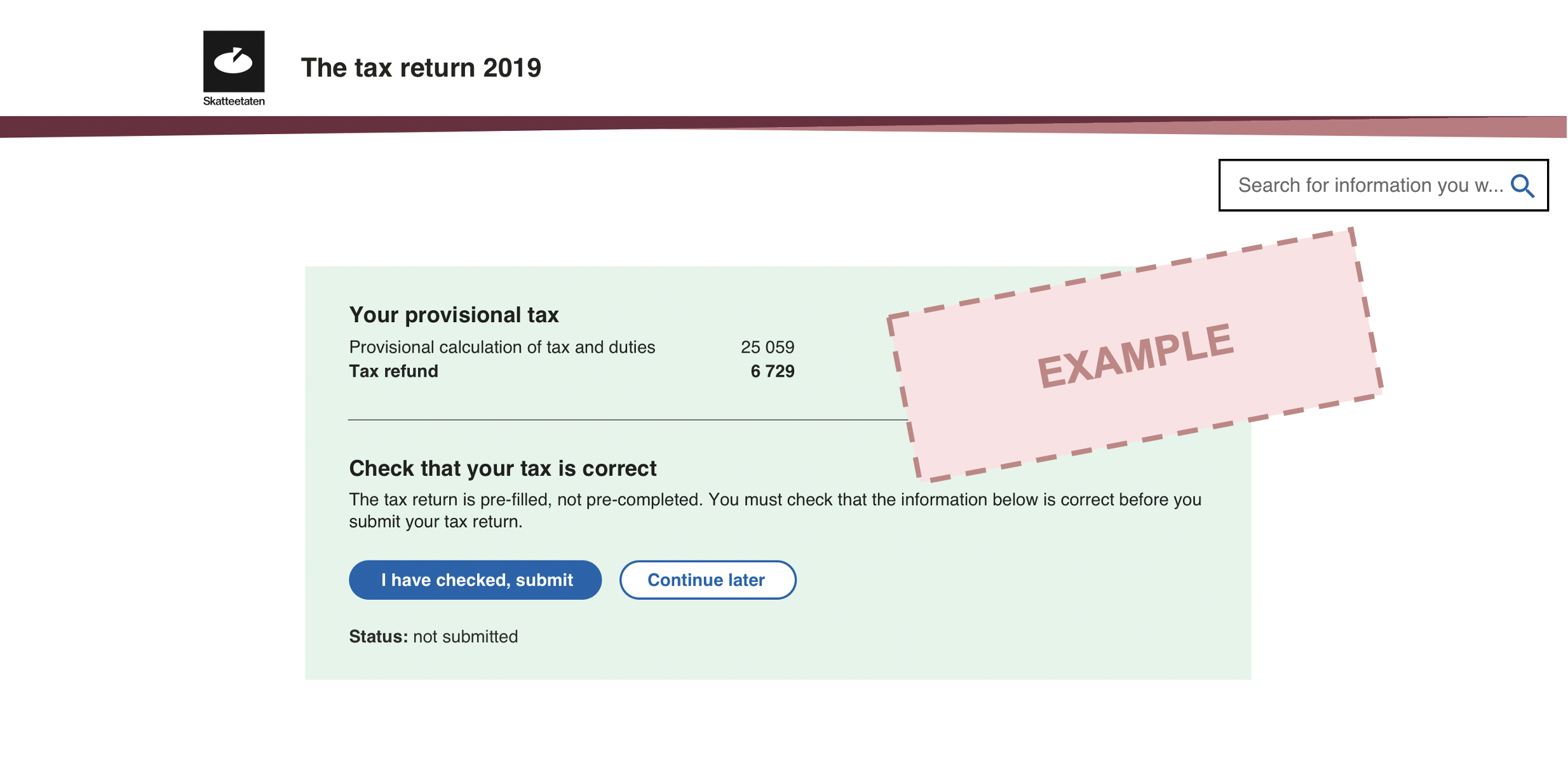

At the top of the tax return, you’ll see a provisional calculation of this year’s tax, the tax refund you’ll get or the amount of tax you’ll have to pay back. This calculation will automatically update if you change something in the tax return.

If you cannot see a provisional tax calculation, it could be because we're missing some information from you. You'll get information about that in the tax return.

You’ll also see the status of your tax return. That means, you’ll see whether you’ve submitted the tax return, or if you’ve made changes that you’ve not submitted yet.

Examples of how it might look:

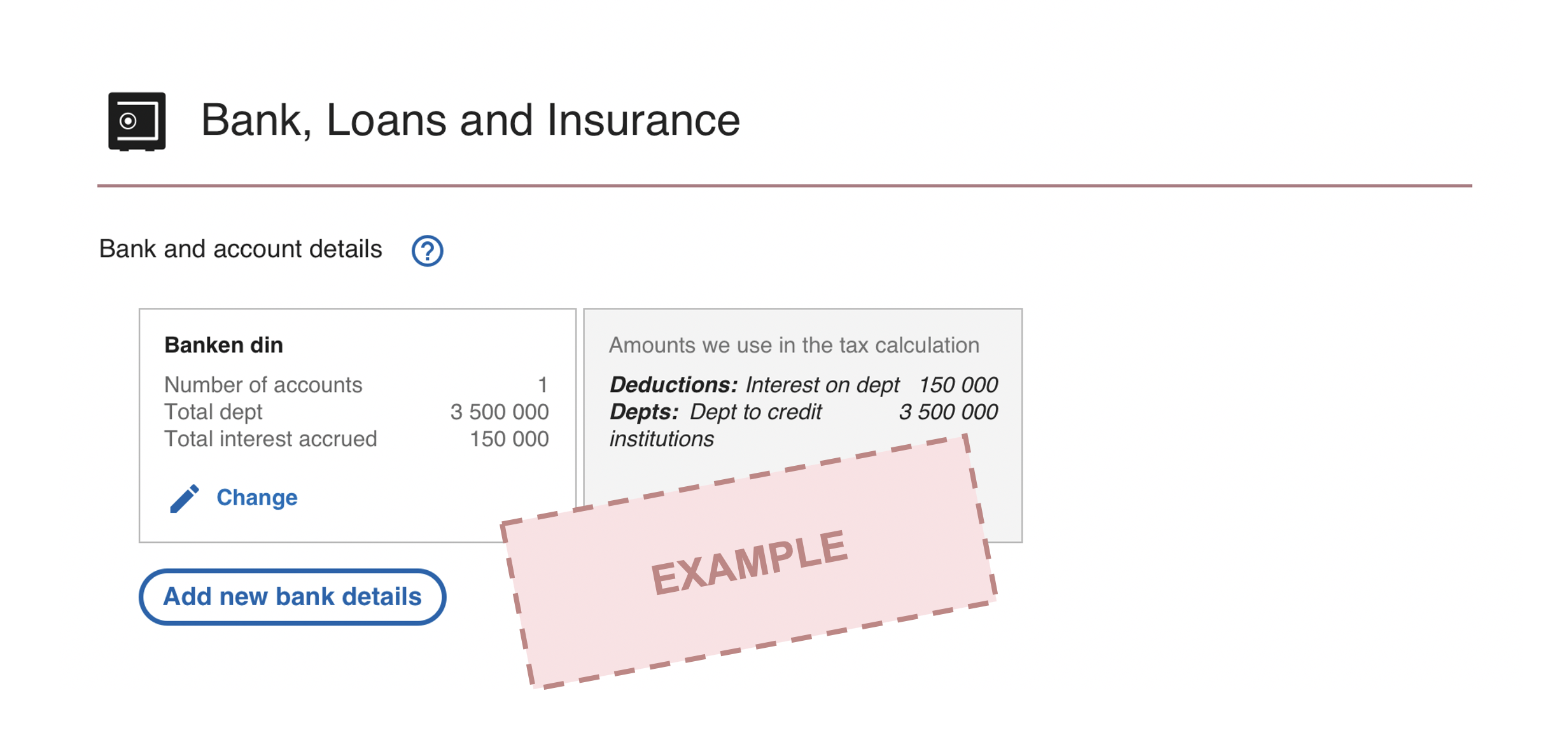

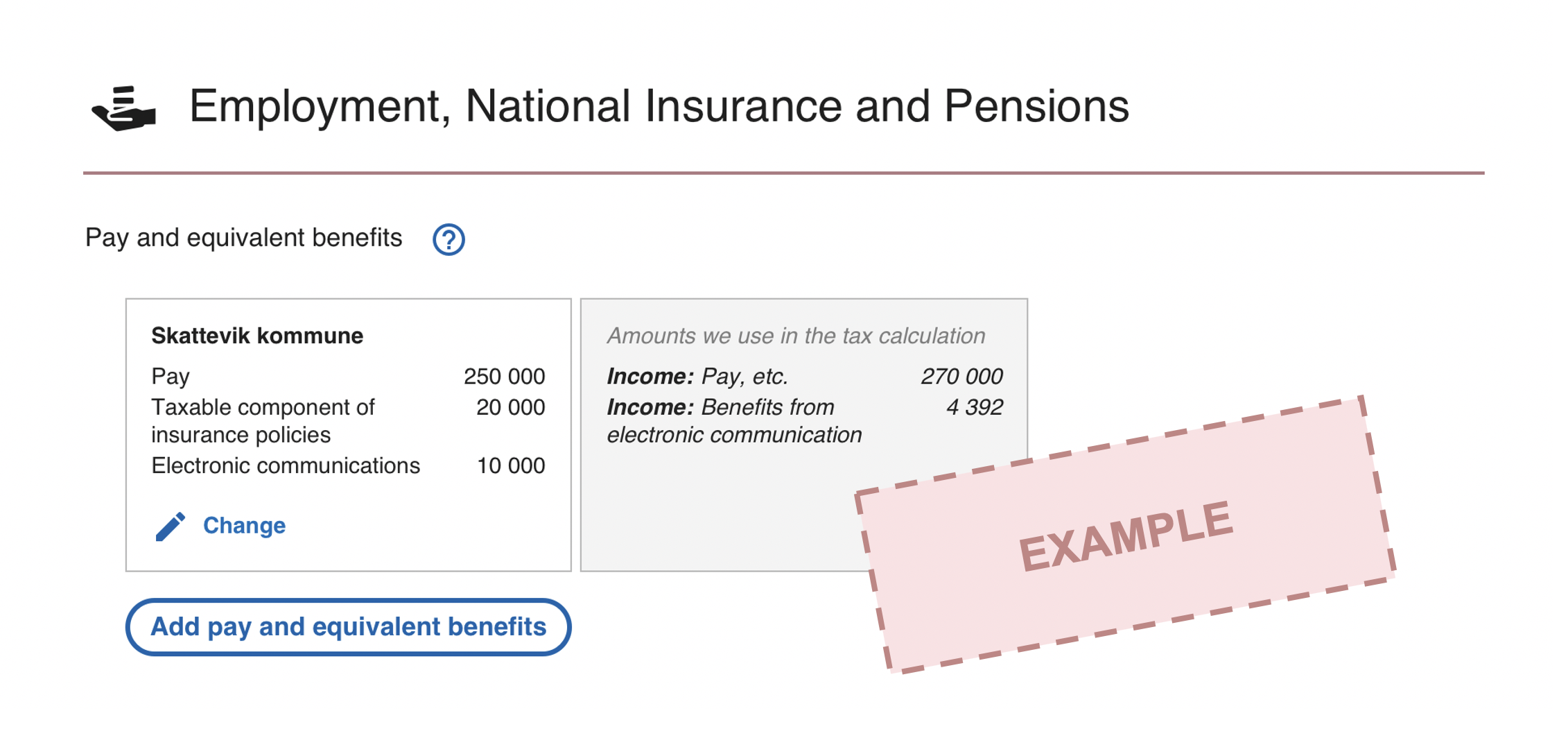

In the new tax return, your information will be sorted into so-called topics instead of numbered items. You’ll find types of information that naturally belong together under each topic. For example, all bank and insurance related information is grouped together under the topic “Bank, loans and insurance”, while information relating to real property, moveable property and renting out is grouped together under “Housing and property”.

The information is grouped together in topics:

- Employment, national insurance and pensions

- Bank, loans and insurance

- Housing and property

- Family and health

- Finance

- Gifts and inheritance

- Method for avoiding double taxation

- Business

- Other circumstances

See the overview of which items that have been replaced by which topics in the new tax return.

This is how it might look:

In the new tax return, it’s likely you no longer have to complete forms that used to be mandatory. Instead, you should log in and enter the information directly in your tax return.

These forms are a part of the tax return:

- RF-1030 Tax return for wealth and income tax

- RF-1125 Use of car

- RF-1147E Deduction for tax paid abroad by a person (credit)

- RF-1150 Reduction of income tax on wages

- RF-1159 Gain, loss, dividend and capital value of shares and other financial products

- RF-1189E Letting etc. of real property

- RF-1231E Deposits in foreign banks

- RF-1175 Income Statement 1

The topic “Business” is available to everyone else. Under the business topic, you will for example be able to transfer surpluses from a spouse with business income or add income from a family day care centre. Self-employed persons with simple tax affairs and income below NOK 50,000 may also use this topic.

Different types of information are grouped together in a single card under each topic. For example, we’ll display all the information relating to your salary from a single employer in a single card. There may be several cards under each topic, depending on how many different tax affairs you have.

If you have several employers, we’ll display each one separately. If your employer has paid for insurance and a phone for you, it’s considered to be a part of your salary and will be added to your income.

We add up all amounts that belong together and display the amount we use to calculate your tax in a summary card. For example, your salary will consist of more than just the salary you received.

This is how it might look:

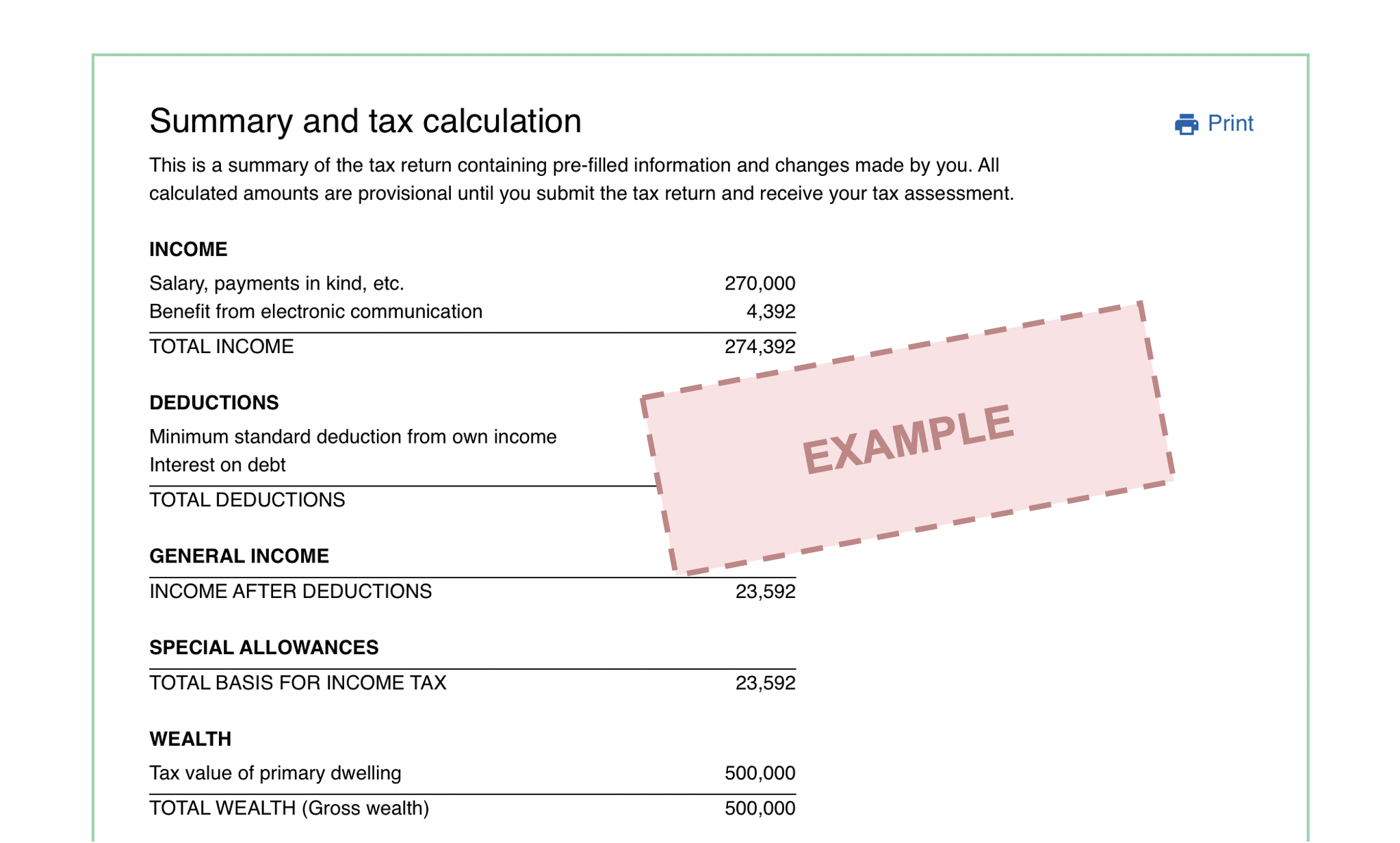

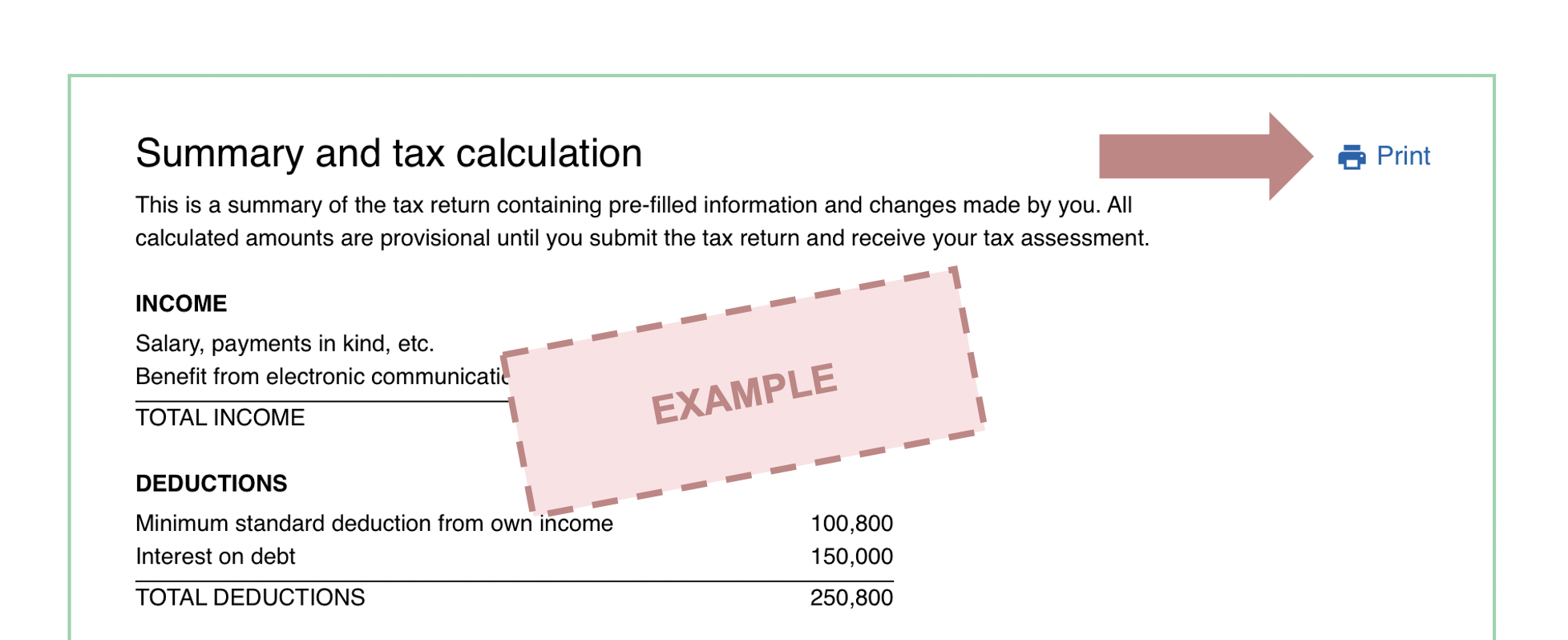

At the bottom of your tax return, we summarise all of your tax affairs including a summary of the amounts we’ve use to calculate your tax.

If you cannot see a provisional tax calculation, it could be because we're missing some information from you. If you add the information, the calculation will be updated, and you'll see the provisional tax calculation.

Examples of how it might look:

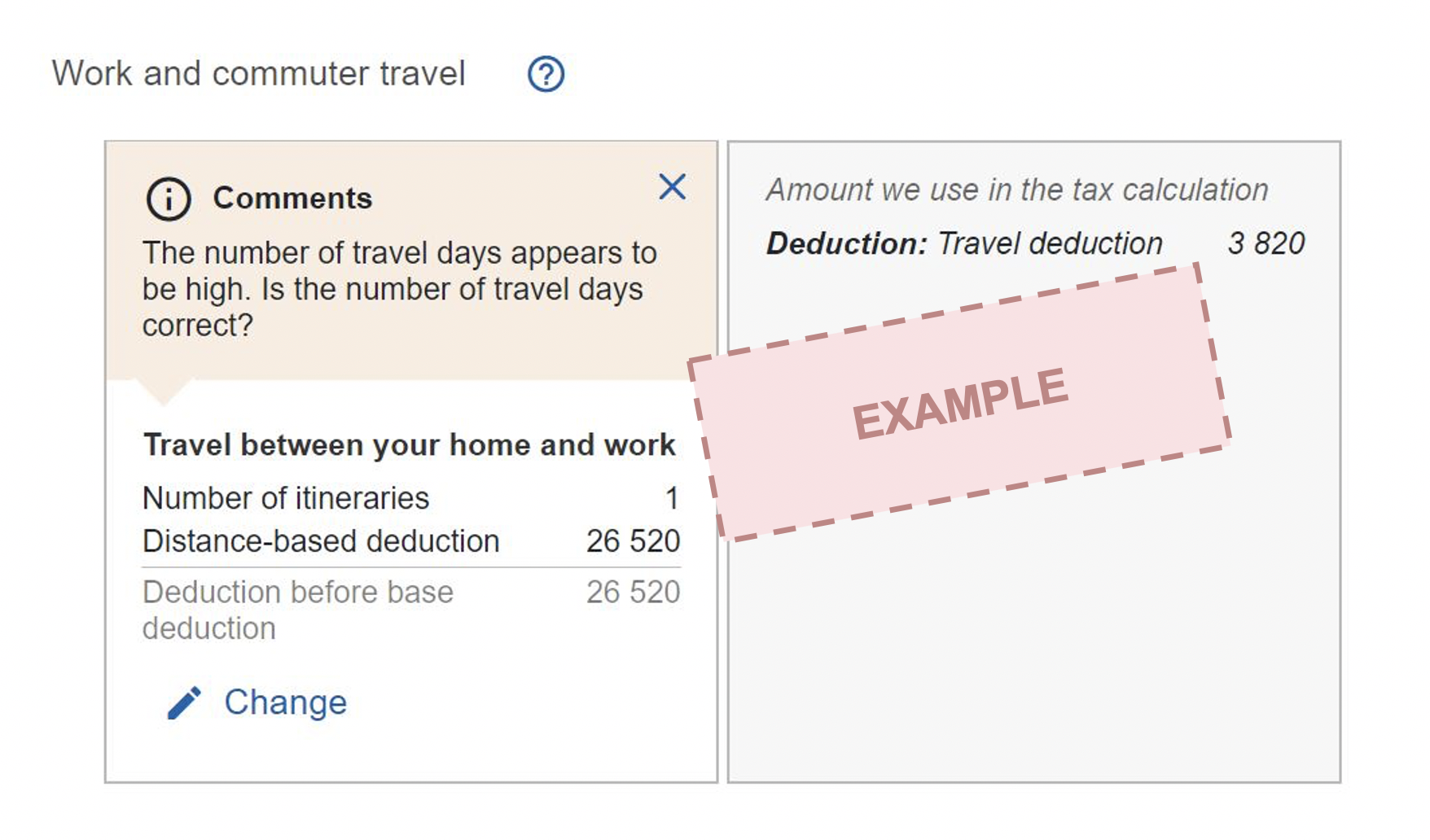

We guide you directly in the tax return in several different ways, including making comments relating to potential mistakes you might have made. For example, if you report interest expenses that are very large compared to your debt, you’ll be asked if this is correct.

We’ll also let you know if you’ve not provided the information we want from you, such as information relating to renting out your residential property or the size of your property. We’ll also let you know if we want you to provide us with evidence of something. This will help you to give us the correct information and help you to get the correct tax assessment.

Examples of how it might look:

Due to the fact that the new version of the tax return is more digital than the previous version, we now have the ability to update your tax return continuously, even after you’ve received your tax return.

For example, we may update your tax return if we receive new information from a third party like your bank or employer.

You can receive new information up until the deadline to submit if you have not submitted your tax return. You'll receive an e-mail from us, unless you have submitted or the deadline to submit has expired. In your tax return, you’ll get a remark that looks like this:

You should check that the information is correct.

This is how you do it

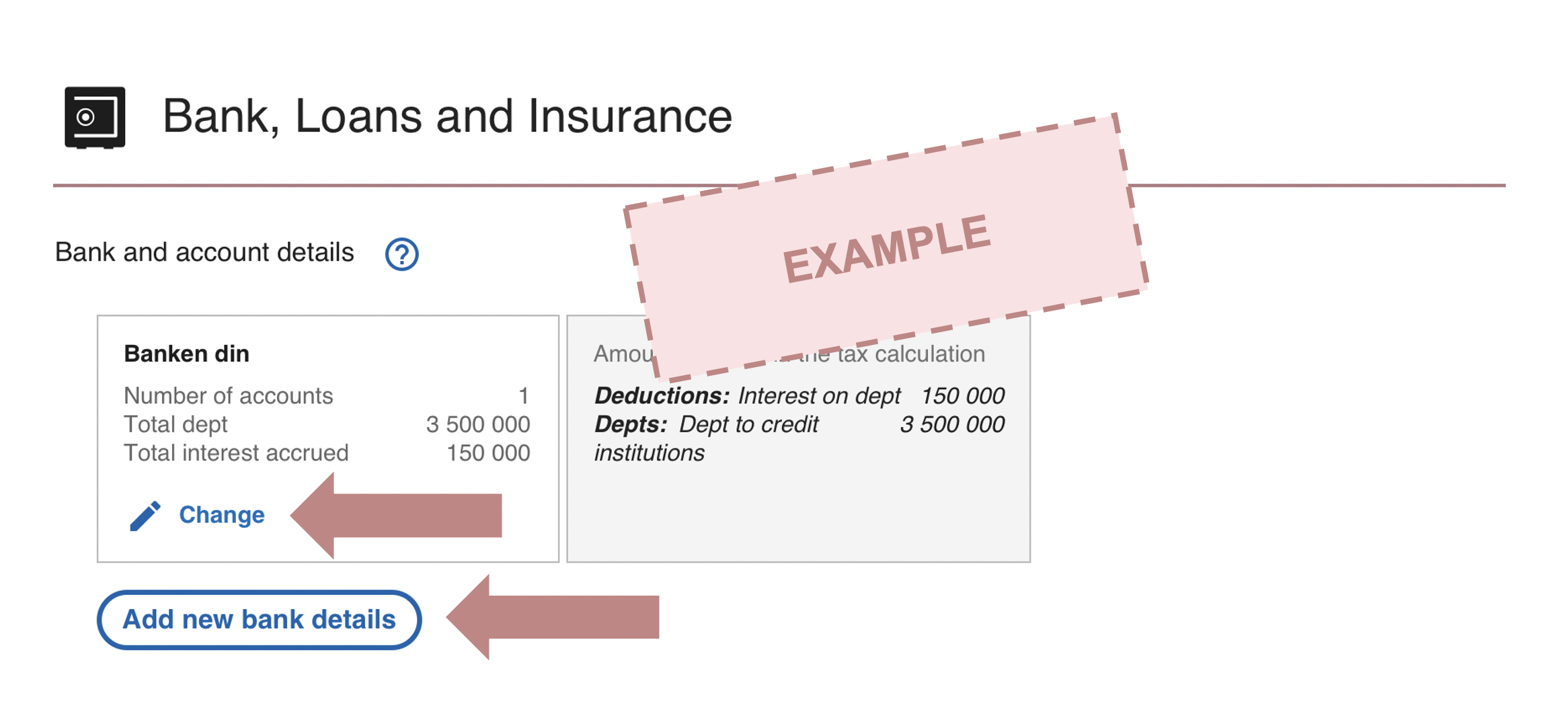

You can add or change pre-filled information in the tax return by clicking on “Add”, or “Change”.

Examples of how it might look:

If there are tax affairs you wish to add please go to "Would you like to provide any other information?" (Ønsker du å oppgi noen andre opplysninger?) and click on “Se all the information you can add" (Se alle opplysninger du kan legge til)

This is how you do it (in Norwegian only):

If you want to download the file or print the tax return for your own use, you can go to the summary and click “Print” in the top right corner.

This is how you do it:

To save the file, click “Print to PDF”.

If you want to send your tax return as documentation to someone else, for instance your municipality or as part of a loan application to your bank, you might need more details than what is provided in the summary in the new tax return.

See how you save, share or print your tax return to use it as documentation.

The new version of the tax return looks like this:

The old version of the tax return looks like this:

This is the new tax return

Watch movie that displays the new tax return, providing you with a simple overview of how to view, edit or submit the tax return.