Change the tax return on paper

If you receive your tax return on paper, you must check that everything is correct, make any necessary changes and submit it. Even if you received your tax return on paper, you can choose to log in and submit it online.

The tax return on paper used to be divided into items. Now we have grouped information that naturally belongs together into topics:

- Employment, national insurance and pensions

- Bank, loans and insurance

- Housing and property

- Family and health

- Finance

- Gifts and inheritance

- Other circumstances

These are the topics you’ll see if you log in to the tax return and check it online.

The most important thing is still for you to continue to check, change or add information to your tax return. If there are no changes to be made, you do not need to submit the tax return.

Even if you received your tax return on paper, you can choose to log in and submit the tax return online.

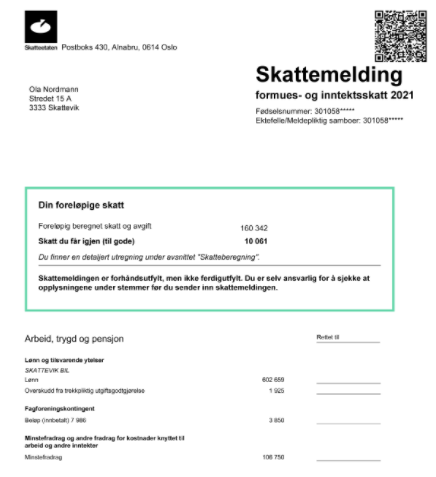

The tax return on paper looks like this:

Make changes to the tax return on paper

Correct and change information

You can enter a new amount if you believe that the pre-filled information under the topics is incorrect or incomplete.

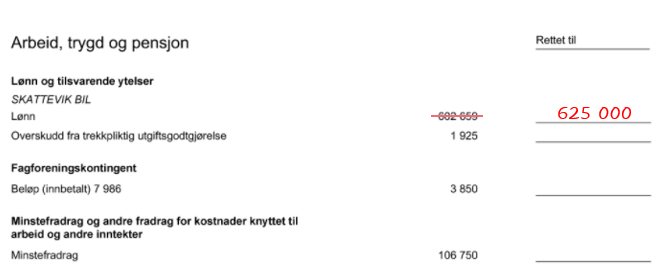

If you believe any pre-filled amount is incorrect, you correct this by crossing out the amount and entering the correct amount in the column “Corrected to.”

This is how this might look:

Add missing information

If there is information that is not pre-filled and that you want to add, you can do so at the bottom of your tax return under “Additional information.”

Please enter the missing information, also stating the country and the amount in question where applicable.

Example:

|

What is this? |

Country |

Amount |

|

Wealth bank account xxxx xx xxxx |

Spain |

NOK 25,000 |

|

Interest income bank account xxxx xx xxxx |

Spain |

NOK 23 |

Download and submit (pdf)

Certain information requires that you submit a form in addition to your tax return (in Norwegian only):

- Formue, utbytte, gevinst og tap på aksjer og andre finansielle produkter

- Bank og kontoopplysninger

- Fradrag for skatt betalt i utlandet, Kreditfradrag

- Næringseiendom

- Avskrivninger

- Salg av eiendom

- Utleie av eiendom

Address

If you have made changes, please send your completed tax return to:

Skatteetaten

Postboks 9357, Grønland

0135 Oslo

Even if you received your tax return on paper, you can choose to log in and submit the tax return online.

Print or share your tax return

If you need a paper version of the tax return you received electronically, you can print the tax return.